How the New Foreign Buyer Tax Impacts Commercial Real Estate

Categories: commercial real estate

Vancouver recently introduced a new rule that will likely affect foreign buyers – a 15% new tax on purchases of $2 million for residential real estate. However, this tax also has a large impact on commercial real estate as well.

New Tax includes Multi-Residential Properties

While some people may think this will only affect residential, there is an impact on commercial activity. The residential real estate for this tax includes apartment buildings.

This could slow down the development and purchases of multi-residential in Vancouver and because of this, we could see an increase in this activity in other markets such as Toronto and Montreal.

Real Estate Affordability Crisis

The reason for this new tax is try and cool the overheating of Vancouver’s real estate, which is mostly caused by the dramatic increase in foreign buyers. Our previous blog looked at whether foreign buying would continue in Canada. The conclusion of that was that the government had not yet introduced any legislation that would have enough of an impact. To address the affordability issue, this new rule could be the first in a line of new laws that will see a change in foreign buying.

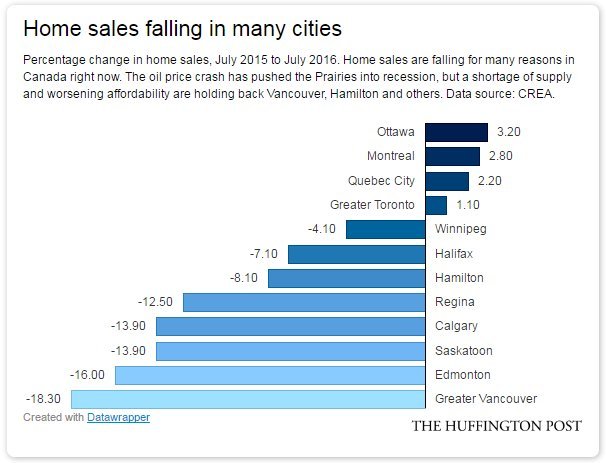

We could already be seeing results. In a report just published this week, sales in Vancouver are down 18.2% compared to the same month a year earlier.

Foreign Buyers in Commercial Real Estate

According to CBRE Canada, as of the second quarter 2016, foreign investors in Canada had bought $2.03 billion in property and $120 million was spent on apartments. 85% of the foreign investment has been in the Vancouver market. While the percentage spent on multi-residential is small in comparison to the overall number, the new tax could still have a great impact.

Will the Tax extend to other Commercial Properties?

So far, there has not been any discussion that this tax will extend to other commercial properties such as industrial, office and industrial properties. However, that doesn’t mean that it won’t ever be extended to commercial properties. The government will want to see the consequences of the tax on residential properties before they make any more decisions.