7 steps to sustain your business through the disruption (BDC)

Categories: COVID-19

The COVID-19 pandemic is having widespread effects on businesses across the country. By mid-March, 73% of companies were already feeling the negative effect of the crisis, according to a BDC survey of over 600 Canadian entrepreneurs.

In times of crisis, cash becomes even more important than it usually is for a company.

Creating a detailed continuity plan and cash flow forecast will help you sustain ongoing operations, albeit at a lower capacity, and facilitate recovery once the crisis is over.

We have all been forced to adapt to what is going on, and we must work through this. We hope the following steps will give you the clarity you need to anticipate and respond on a day-to-day basis, allow you to control your cash flow, and establish operational resilience.

1. Start with health and security

Covid-19 is a human problem—a human response is in order—so let’s take care of our people first. Here are some important questions you can ask.

Have you implemented best practices to keep employees safe?

For those of you who are still in operation, identify the health and safety practices you must take to prevent further transmission. Institute the necessary safe distance practices and incorporate the use of gloves, plexiglass barriers, and so on.

Can your people work remotely?

As much as possible, allow your employees to work from home to minimize contact and maintain social distance. Can you start selling online? Can your services be delivered remotely? Are you able to quickly launch a delivery service? Do your best to implement solutions that can maintain a portion of your revenues while keeping employees and customers safe.

Do you have a contingency plan for quarantined employees?

What will you do if one or more of your employees is quarantined and can no longer come into work? Can someone else take their place? It can be an idea, for instance, to create different work teams to minimize the risk of your entire crew being forced to isolate.

Is paperwork being expedited to reduce financial distress of laid-off employees?

Be sensitive to the financial distress personnel may be experiencing especially look for options to alleviate this the best way you can. This will go a long way toward building employee loyalty.

2. Prepare a communication plan

You can never communicate too much during a crisis. Your communication plan should target:

- employees

- customers

- suppliers

Carefully craft a clear and concise message, schedule regular updates and optimize technology to send your messages. Put someone you trust in charge of doing this. It’s a very important job.

3. Reach out to customers

As you start to make changes in the way you do business over the short term, there will be a corresponding effect on your cash flow. And with changes to your plan, you need to take the time to understand the financial impact of these changes and develop a cash flow forecast that reflects these changes.

Confirm that orders are still on track

The first thing to do is to contact your customers. For those of you continuing operations, call your main customers and confirm that existing and planned orders are still on track.

You do not necessarily need to renegotiate payment terms, but you may have to defer production or loosen repayment terms, which will slow down cash intake.

Do your best to understand how these changes will impact the timing and value of payment milestones.

Ask for receivables

Second, start calling customers that owe you money. You need to understand whether they have the ability to pay and the timing of payments.

By being proactive, you can get clarity about when the money may come in. Over the next six to twelve weeks, keep an eye on this regularly—if a customer promises to pay in two weeks, follow up with a gentle reminder one week in advance and invite them to be open with you if they are still experiencing difficulty.

This should be one of the top three things you review every morning from hereon.

Propose additional services

Finally, as you reach out your customers, be courageous and ask them if they need anything else—its possible another supplier has let them down, maybe you can fill the gap. Look at this as an opportunity to explore other options that could bring in additional cash.

4. Reach out to suppliers

Supply chains are constrained and if your supplier is overseas or relies on imports you risk disappointing your customer. So, get in touch!

Confirm timely delivery of supplies

Call suppliers to confirm whether existing purchase orders will be filled on time. Delays with suppliers could hold up your production. It’s good to know this early so you can manage your customers’ expectations and to update your cash flow plan. You may experience lower cash out flows if suppliers are delayed. Or if everything is on track, your cash outflows may increase.

Negotiate differed payments

If possible, try to negotiate deferred payment terms for payables. Like receivables, you need to keep any eye on this regularly. If you promised to pay a supplier in two weeks and cannot—give them advance notice—you expect it from your customers, so extend the same curtesy to suppliers. Again, you may experience lower cash outflows if suppliers agree to later payments.

Identify health and safety suppliers

Finally, as you change your health and safety practices, there may be a need to source other types of consumables. Be prepared to spend money on this; plan for replenishment just as you would for other materials and consumables.

5. Evaluate capacity and resources

Now for the additional things you need to do beyond managing customers and suppliers.

Modify health and safety practices

You will need to change your health and safety practices. Industry leaders, for example, are telling customers how they are packing and handling products in light of COVID-19. You have the same responsibility. This will have a cost impact. Estimate the impact and factor it into your plan.

Align workforce to demand projections

As demand dips, alignment of your personnel to production will be your next challenge. Some of you have already dealt with this, others will need to deal with it soon.

New Temporary Wage Subsidy for Employers will be helpful to maintain as much of your workforce as possible.

Right-size recurring operating expenditures

Third, look to find recurring operating expenses that can be suspended in the short term.

- Would your landlord be amenable to a postponement of rent?

- Can you temporarily reduce some of your communications expenses?

- Can you stop getting laundry services for uniforms?

A line by line review of your expense items is critical to see where you can shave costs over the short term. Every penny will count. You may also find other more sustainable cost savings from which you will benefit after recovery.

As each new invoice comes in, question whether the expense is really necessary.

And of course, this is obvious, simply defer discretionary expenditures. Examples of these could be meals, travel, and the such.

6. Compile your weekly rolling cash flow plan

You now have some very specific strategies you can implement. Putting them together into a cashflow plan will allow you to determine exactly how much working capital you need.

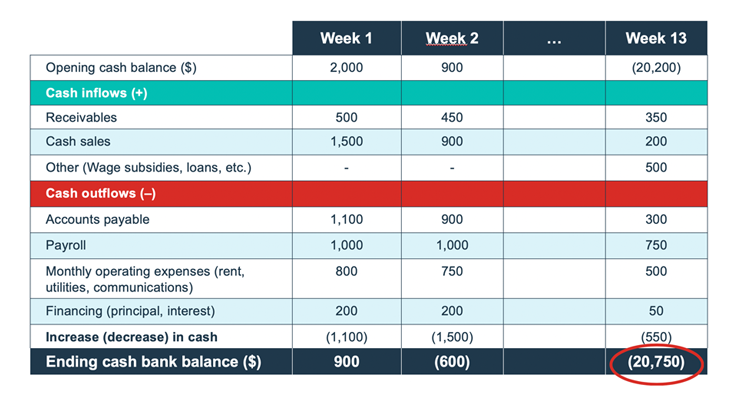

Here we present a spreadsheet that itemizes cash flows from week to week. Notice that we refer to it as a rolling cash flow forecast. This means it must be updated at the beginning and end of each week. It is forward looking over a thirteen-week period, but you may need a longer duration.

The cash flow plan acts like a gas gauge for your business. Cash is fuel for your company; the cash flow plan is your gauge for how much working capital you need to reach your post-recovery destination.

List cash inflows

First, we list the inflows: Receivables and cash sales, other subsidies could also be a source of cash. You would have obtained this information from conversations with your customers.

For illustrative purposes we show how cash inflows from receivables fall as the weeks progress. This may not be true for you.

List cash outflows

Next we list the cash outflows: Payables, recurring monthly payments, and so on.

By now you have analyzed your expenditures, and you have taken remedial actions to right-size employees and operating expenses. You have mapped these out over time, giving you a sense of how your money is going to leave the business. You will also need to include your lending obligations.

Analyze the cash flow forecast

With cash inflows and outflows all mapped out, you’ll be ready to analyze the results. In this case, the entrepreneur at the beginning of Week 1 has a starting cash balance of $2,000. They expect to have a net outlay of $1,100 and lowering their cash balance at the end of the week to $900.

They are good for Week 1. But look at what happens in Week 2—the outflows start to drain the bank account to a deficit position. After 13 weeks, there is a shortage of $20,750.

The goal of this exercise is to figure out what that number is for you. This will tell you how much working capital you need and provide you with information to support a working capital loan request.

If you love cash flow modelling and have the time, you can look at different scenarios, and so on. It is up to you. Your accountant can help too. Call them and see if they can. Time is of the essence.

7. Prepare for the recovery

There is a light at the end of the tunnel. We just don’t know how long that tunnel is.

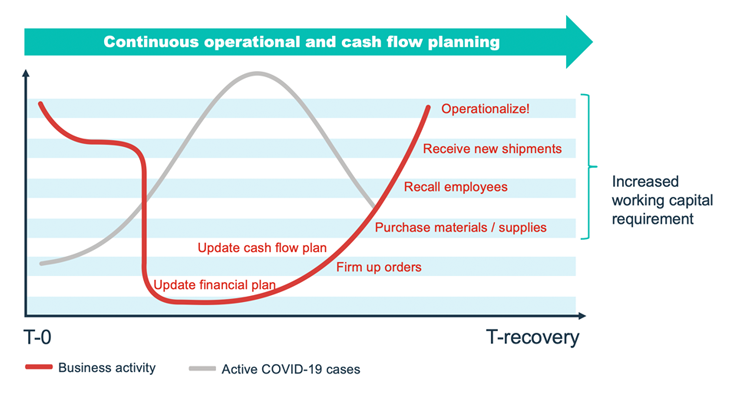

Here we have overlaid business activity against active COVID-19 cases. You will see that once the cases have peaked, we will recover. At recovery you will need to stay ahead of the game:

- firm up orders

- purchase materials

- recall employees

- receive new shipments

- operationalize

Plan your cash flow for the recovery phase as well. When things start to turn on, you will need to spend money to earn money. It would be a shame to ride the dip and then not have the enough resources to bring your business back to normal.

In our opinion, all your plans should include at least a four-week recovery period. As you roll your cash flow forward each week, this recovery will be automatically built into your working capital estimates. With orders back in your business, you will have the funds for operations.